In today’s summer economic update the Chancellor has announced a stamp duty holiday that will start immediately and run until March next year. Property buyers could save thousands of pounds thanks to the new tax break, which will be welcome by all home buyers.

Prior to the announcement, the threshold where you start paying stamp duty was £125,000, or £300,000 for first-time buyers (if buying a property worth less than £500,000). The stamp duty threshold has been raised from £300,000 to £500,000 which means savings on stamp duty for home buyers and investors.

The change will apply in England and Northern Ireland only.

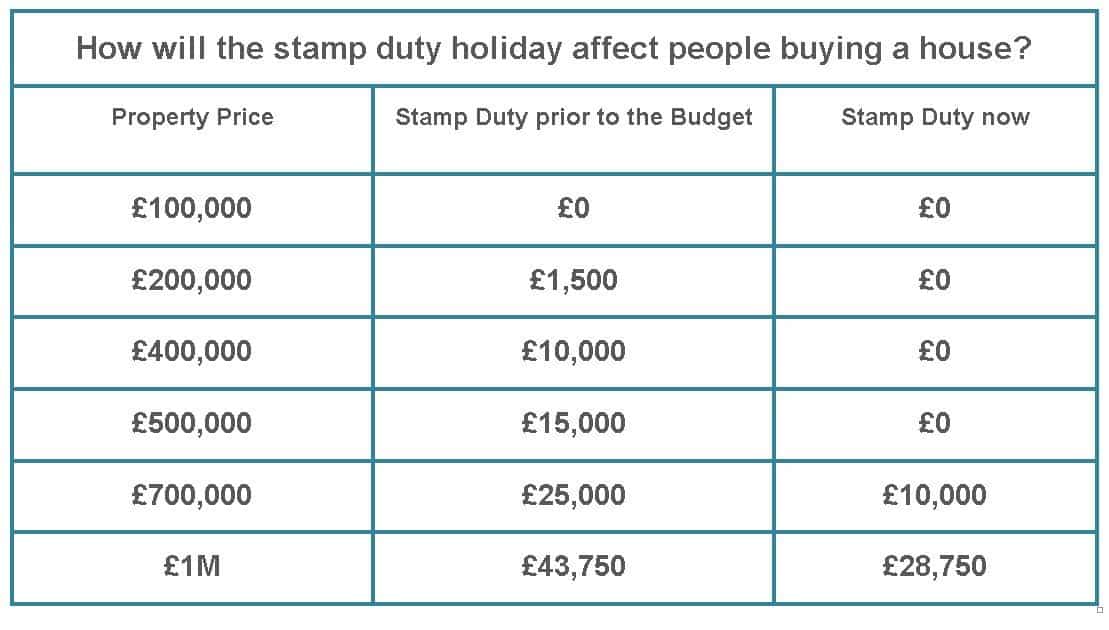

The table below illustrates the changes.

What is Stamp Duty?

What is Stamp Duty?

Stamp Duty is a lump-sum tax that anyone buying a property or land costing more than a set amount has to pay. The amount of tax you will have to pay varies based on the property price. The amounts can be quite significant and you will have to factor this into your budget when considering how much deposit you need to buy a house.

Who qualifies?

Whilst first time buyers were the focus in our last stamp duty update, the latest break applies to everyone buying a home. Those buyers purchasing second homes or buy-to-let properties as investments will also benefit from the stamp duty holiday, whether they buy as individuals or via their limited companies, up to £500,000. These buyers must remember the pre-existing 3% surcharge will still apply.

When do the changes take place?

The relief applies to all purchases from today (8 July 2020). If you have already exchanged contracts, as long as completion is from today onwards you will benefit from the increased thresholds.

For more information on buying a house, please contact a member of our Residential Conveyancing Department.