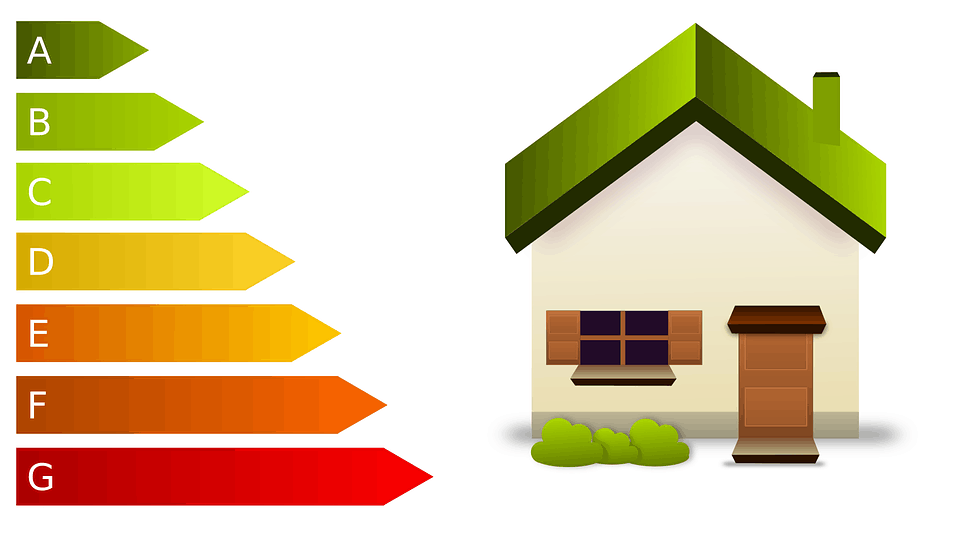

For most residential lettings, a Landlord has to have an Energy Performance Certificate (“EPC”) before they let a property. As part of the government’s strive for energy efficiency, with effect from 1 April 2018, a Landlord should not grant a new tenancy/lease if the property has an EPC rating below E. This is according to Part Three of The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015, known as the MEES Regulations.

From 1 April 2020, the MEES Regulations apply to existing tenancies of domestic properties (usually granted prior to 1 April 2018) and from 1 April 2023 to commercial properties.

This article gives an overview of the Regulations and will focus on domestic private rented properties. Broadly, this term covers ordinary lettings of properties by a private landlord.

What to do if your property has an EPC rating of less than E?

- A Landlord should check the MEES Regulations apply to the property and the type of tenancy.

- A Landlord should carry out “relevant energy efficiency improvements” (for the meaning of which see below) to bring the EPC rating above the minimum threshold, unless an exemption to the MEES Regulations (as set out in the PRS Exemptions Register) applies.

The exemptions are:-

- No funding exemption – If the costs of purchasing and installing the “relevant energy efficiency improvements” cannot be financed at no cost to the Landlord.

- The consent exemption – A Tenant or other third party refuses to give consent to the relevant works being carried out to increase the energy efficiency or the Tenant refuses to give Consent to Green Deal funding.

- The devaluation exemption – A Landlord has obtained a report from a Surveyor, which shows that the works to improve the energy efficiency would result in a reduction of more than five per cent in the value of the property.

- Temporary exemption – In some situations, a Landlord (usually if the Landlord has recently acquired the property) may be given six months to comply with the prohibition on letting and carry out the relevant energy efficiency improvements.

- Wall insulation exemption – If a Landlord has obtained written expert advice that cavity wall insulation, external wall insulation or internal wall insulation is not appropriate due to its negative impact on the structure of the property.

- Although not classified as an exemption, if all relevant energy efficiency improvement works have been carried out but the property still has an EPC rating of lower than E, it may be let and the Landlord has up to five years to grant new lettings or continue existing lettings.

For all exemptions, the Landlord must register the property and his/her details on the PRS Exemptions Register. The exemption is to be registered before it can be relied upon.

A relevant energy efficient improvement is a list of recommendations (often detailed on the EPC or a Surveyor’s report) and the impact they will have. If such works are required, they must be one of the following:-

- A measure to improve efficiency in the use of energy in the property and;

- Identified as an improvement for the property in question.

- Can also include installation of a service pipe for the supply of gas, if the property is not fuelled by mains gas and is situated 23 metres from the main of a gas transporter.

If a Landlord does not carry out the energy efficiency improvements and does not register the property on the PRS Exemptions Register, or puts false or mis-leading information on the PRS Exemptions register, a Landlord is likely to face enforcement action. This could mean a fine, depending on the type of breach up to £5,000 per breach for each property and/or publication of a notice detailing the non-compliant property, details of the breach of the MEES Regulations, the financial penalty (if any) and the Landlord’s details but not if the Landlord is an individual.

UPDATE

On 5 November 2018, following a consultation, the Government confirmed that new Regulations will shortly be put before Parliament. These will apply on the grant of a new tenancy to a new tenant or an existing tenant. These Regulations will remove the “no cost to Landlord” principle and:-

- Introduce a Landlord contribution towards any works required to improve energy efficiency capped at £3,500 including VAT. Any energy efficiency measures undertaken since October 2017, will be included within the £3,500 cap, as will any available third party funding

- There will be a new “high cost” exemption if the EPC grading of E of a property cannot be achieved for £3,500 or less. Landlords will have to obtain three quotes, to enable registration of this exemption on the PRS Register

- The “consent exemption” referred to above will be removed where a tenant has withheld consent to a Green Deal finance plan.

For advice and guidance on these issues or other Landlord/Tenant issues contact our litigation team.