- 8 July 2020

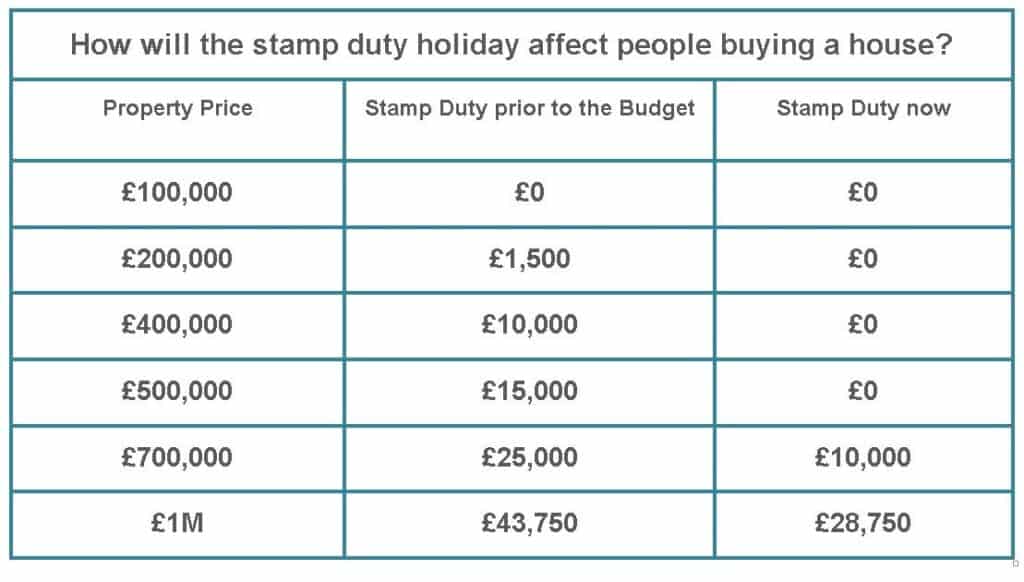

New Stamp Duty Charges for Residential Property Purchases

- 1 July 2020

Legal update from our Employment & Litigation team

- 1 April 2020

CORONAVIRUS – Legal Update from our Employment & Litigation team

- 26 February 2020

Death Bed Gifts

- 17 January 2020

New Employment Laws – Are You Ready?

- 2 December 2019

Equal Rights

- 4 September 2019

Organ Donation Week

- 27 June 2019

When it is too hot to work?

- 31 May 2019

Continuing Best Practice following a successful Lexcel Assessment